This weekend, House Republican leader John Boehner played out the role of Jude Wanniski on NBC's "Meet The Press."

Odds are you've never heard of Jude, but without him Reagan never would have become a "successful" president, Republicans never would have taken control of the House or Senate, Bill Clinton never would have been impeached, and neither George Bush would have been president.

When Barry Goldwater went down to ignominious defeat in 1964, most Republicans felt doomed (among them the then-28-year-old Wanniski). Goldwater himself, although uncomfortable with the rising religious right within his own party and the calls for more intrusion in people's bedrooms, was a diehard fan of Herbert Hoover's economic worldview.

In Hoover's world (and virtually all the Republicans since reconstruction with the exception of Teddy Roosevelt), market fundamentalism was a virtual religion. Economists from Ludwig von Mises to Friedrich Hayek to Milton Friedman had preached that government could only make a mess of things economic, and the world of finance should be left to the Big Boys – the Masters of the Universe, as they sometimes called themselves – who ruled Wall Street and international finance.

Hoover enthusiastically followed the advice of his Treasury Secretary, multimillionaire Andrew Mellon, who said in 1931: "Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. Purge the rottenness out of the system. High costs of living and high living will come down... enterprising people will pick up the wrecks from less competent people."

Thus, the Republican mantra was: "Lower taxes, reduce the size of government, and balance the budget."

The only problem with this ideology from the Hooverite perspective was that the Democrats always seemed like the bestowers of gifts, while the Republicans were seen by the American people as the stingy Scrooges, bent on making the lives of working people harder all the while making richer the very richest. This, Republican strategists since 1930 knew, was no way to win elections.

Which was why the most successful Republican of the 20th century up to that time, Dwight D. Eisenhower, had been quite happy with a top income tax rate on millionaires of 91 percent. As he wrote to his brother Edgar Eisenhower in a personal letter on November 8, 1954:

"[T]o attain any success it is quite clear that the Federal government cannot avoid or escape responsibilities which the mass of the people firmly believe should be undertaken by it. The political processes of our country are such that if a rule of reason is not applied in this effort, we will lose everything--even to a possible and drastic change in the Constitution. This is what I mean by my constant insistence upon 'moderation' in government.

"Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group, of course, that believes you can do these things. Among them are H. L. Hunt [you possibly know his background], a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid."

Goldwater, however, rejected the "liberalism" of Eisenhower, Rockefeller, and other "moderates" within his own party. Extremism in defense of liberty was no vice, he famously told the 1964 nominating convention, and moderation was no virtue. And it doomed him and his party.

And so after Goldwater's defeat, the Republicans were again lost in the wilderness just as after Hoover's disastrous presidency. Even four years later when Richard Nixon beat LBJ in 1968, Nixon wasn't willing to embrace the economic conservatism of Goldwater and the economic true believers in the Republican Party. And Jerry Ford wasn't, in their opinions, much better. If Nixon and Ford believed in economic conservatism, they were afraid to practice it for fear of dooming their party to another forty years in the electoral wilderness.

By 1974, Jude Wanniski had had enough. The Democrats got to play Santa Claus when they passed out Social Security and Unemployment checks – both programs of the New Deal – as well as when their "big government" projects like roads, bridges, and highways were built giving a healthy union paycheck to construction workers. They kept raising taxes on businesses and rich people to pay for things, which didn't seem to have much effect at all on working people (wages were steadily going up, in fact), and that made them seem like a party of Robin Hoods, taking from the rich to fund programs for the poor and the working class. Americans loved it. And every time Republicans railed against these programs, they lost elections.

Everybody understood at the time that economies are driven by demand. People with good jobs have money in their pockets, and want to use it to buy things. The job of the business community is to either determine or drive that demand to their particular goods, and when they're successful at meeting the demand then factories get built, more people become employed to make more products, and those newly-employed people have a paycheck that further increases demand.

Wanniski decided to turn the classical world of economics – which had operated on this simple demand-driven equation for seven thousand years – on its head. In 1974 he invented a new phrase – "supply side economics" – and suggested that the reason economies grew wasn't because people had money and wanted to buy things with it but, instead, because things were available for sale, thus tantalizing people to part with their money. The more things there were, the faster the economy would grow.

At the same time, Arthur Laffer was taking that equation a step further. Not only was supply-side a rational concept, Laffer suggested, but as taxes went down, revenue to the government would go up!

Neither concept made any sense – and time has proven both to be colossal idiocies – but together they offered the Republican Party a way out of the wilderness.

Ronald Reagan was the first national Republican politician to suggest that he could cut taxes on rich people and businesses, that those tax cuts would cause them to take their surplus money and build factories or import large quantities of cheap stuff from low-labor countries, and that the more stuff there was supplying the economy the faster it would grow. George Herbert Walker Bush – like most Republicans of the time – was horrified. Ronald Reagan was suggesting "Voodoo Economics," said Bush in the primary campaign, and Wanniski's supply-side and Laffer's tax-cut theories would throw the nation into such deep debt that we'd ultimately crash into another Republican Great Depression.

But Wanniski had been doing his homework on how to sell supply-side economics. In 1976, he rolled out to the hard-right insiders in the Republican Party his "Two Santa Clauses" theory, which would enable the Republicans to take power in America for the next thirty years.

Democrats, he said, had been able to be "Santa Clauses" by giving people things from the largesse of the federal government. Republicans could do that, too – spending could actually increase. Plus, Republicans could be double Santa Clauses by cutting people's taxes! For working people it would only be a small token – a few hundred dollars a year on average – but would be heavily marketed. And for the rich it would amount to hundreds of billions of dollars in tax cuts. The rich, in turn, would use that money to import or build more stuff to market, thus increasing supply and stimulating the economy. And that growth in the economy would mean that the people still paying taxes would pay more because they were earning more.

There was no way, Wanniski said, that the Democrats could ever win again. They'd have to be anti-Santas by raising taxes, or anti-Santas by cutting spending. Either one would lose them elections.

When Reagan rolled out Supply Side Economics in the early 80s, dramatically cutting taxes while exploding (mostly military) spending, there was a moment when it seemed to Wanniski and Laffer that all was lost. The budget deficit exploded and the country fell into a deep recession – the worst since the Great Depression – and Republicans nationwide held their collective breath. But David Stockman came up with a great new theory about what was going on – they were "starving the beast" of government by running up such huge deficits that Democrats would never, ever in the future be able to talk again about national health care or improving Social Security – and this so pleased Alan Greenspan, the Fed Chairman, that he opened the spigots of the Fed, dropping interest rates and buying government bonds, producing a nice, healthy goose to the economy. Greenspan further counseled Reagan to dramatically increase taxes on people earning under $37,800 a year by increasing the Social Security (FICA/payroll) tax, and then let the government borrow those newfound hundreds of billions of dollars off-the-books to make the deficit look better than it was.

Reagan, Greenspan, Winniski, and Laffer took the federal budget deficit from under a trillion dollars in 1980 to almost three trillion by 1988, and back then a dollar could buy far more than it buys today. They and George HW Bush ran up more debt in eight years than every president in history, from George Washington to Jimmy Carter, combined. Surely this would both starve the beast and force the Democrats to make the politically suicidal move of becoming deficit hawks.

And that's just how it turned out. Bill Clinton, who had run on an FDR-like platform of a "new covenant" with the American people that would strengthen the institutions of the New Deal, strengthen labor, and institute a national health care system, found himself in a box. A few weeks before his inauguration, Alan Greenspan and Robert Rubin sat him down and told him the facts of life: he was going to have to raise taxes and cut the size of government. Clinton took their advice to heart, raised taxes, balanced the budget, and cut numerous programs, declaring an "end to welfare as we know it" and, in his second inaugural address, an "end to the era of big government." He was the anti-Santa Claus, and the result was an explosion of Republican wins across the country as Republican politicians campaigned on a platform of supply-side tax cuts and pork-rich spending increases.

Looking at the wreckage of the Democratic Party all around Clinton by 1999, Winniski wrote a gloating memo that said, in part: "We of course should be indebted to Art Laffer for all time for his Curve... But as the primary political theoretician of the supply-side camp, I began arguing for the 'Two Santa Claus Theory' in 1974. If the Democrats are going to play Santa Claus by promoting more spending, the Republicans can never beat them by promoting less spending. They have to promise tax cuts..."

Ed Crane, president of the Libertarian CATO Institute, noted in a memo that year: "When Jack Kemp, Newt Gingich, Vin Weber, Connie Mack and the rest discovered Jude Wanniski and Art Laffer, they thought they'd died and gone to heaven. In supply-side economics they found a philosophy that gave them a free pass out of the debate over the proper role of government. Just cut taxes and grow the economy: government will shrink as a percentage of GDP, even if you don't cut spending. That's why you rarely, if ever, heard Kemp or Gingrich call for spending cuts, much less the elimination of programs and departments."

George W. Bush embraced the Two Santa Claus Theory with gusto, ramming through huge tax cuts – particularly a cut to a maximum 15 percent income tax rate on people like himself who made their principle income from sitting around the pool waiting for their dividend or capital gains checks to arrive in the mail – and blowing out federal spending. Bush even out-spent Reagan, which nobody had ever thought would again be possible.

And it all seemed to be going so well, just as it did in the early 1920s when a series of three consecutive Republican presidents cut income taxes on the uber-rich from over 70 percent to under 30 percent. In 1929, pretty much everybody realized that instead of building factories with all that extra money, the rich had been pouring it into the stock market, inflating a bubble that – like an inexorable law of nature – would have to burst. But the people who remembered that lesson were mostly all dead by 2005, when Jude Wanniski died and George Gilder celebrated the Reagan/Bush supply-side-created bubble economies in a Wall Street Journal eulogy:

"...Jude's charismatic focus on the tax on capital gains redeemed the fiscal policies of four administrations. ... [T]he capital-gains tax has come erratically but inexorably down -- while the market capitalization of U.S. equities has risen from roughly a third of global market cap to close to half. These many trillions in new entrepreneurial wealth are a true warrant of the worth of his impact. Unbound by zero-sum economics, Jude forged the golden gift of a profound and passionate argument that the establishments of the mold must finally give way to the powers of the mind. He audaciously defied all the Buffetteers of the trade gap, the moldy figs of the Phillips Curve, the chic traders in money and principle, even the stultifying pillows of the Nobel Prize."

In reality, his tax cuts did what they have always done over the past 100 years – they initiated a bubble economy that would let the very rich skim the cream off the top just before the ceiling crashed in on working people.

The Republicans got what they wanted from Wanniski's work. They held power for thirty years, made themselves trillions of dollars, cut organized labor's representation in the workplace from around 25 percent when Reagan came into office to around 8 of the non-governmental workforce today, and left such a massive deficit that some misguided "conservative" Democrats are again clamoring to shoot Santa with working-class tax hikes and entitlement program cuts.

And now Boehner, McCain, Brooks, and the whole crowd are again clamoring to be recognized as the ones who will out-Santa Claus the Democrats. You'd think after all the damage they've done that David Gregory would have simply laughed Boehner off the program – much as the American people did to the Republicans in the last election – although Gregory is far too much a gentleman for that. Instead, he merely looked incredulous; it was enough.

The Two Santa Claus theory isn't dead, as we can see from today's Republican rhetoric. Hopefully, though, reality will continue to sink in with the American people and the massive fraud perpetrated by Wanniski, Reagan, Laffer, Graham, Bush(s), and all their "conservative" enablers will be seen for what it was and is. And the Obama administration can get about the business of repairing the damage and recovering the stolen assets of these cheap hustlers.

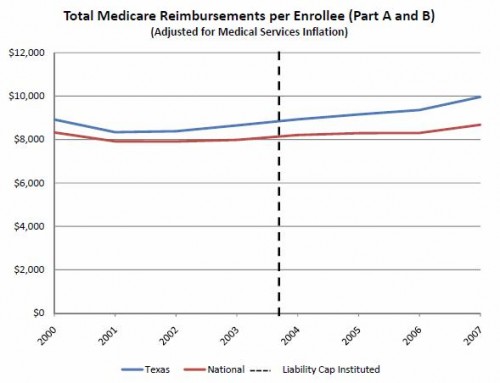

That dotted line is when tort reform when into effect. Not only were costs for Medicare enrollees not controlled, they went up faster than the national average. In fact, Texas reimbursement rates in 2007 were the second highest in the country. What exactly did Governor Perry and Speaker Gingrich mean by “successful”?

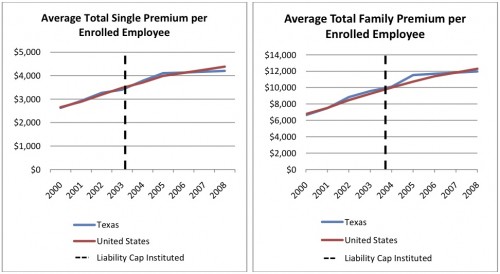

That dotted line is when tort reform when into effect. Not only were costs for Medicare enrollees not controlled, they went up faster than the national average. In fact, Texas reimbursement rates in 2007 were the second highest in the country. What exactly did Governor Perry and Speaker Gingrich mean by “successful”? Health insurance premiums again did not see a dramatic decrease after tort reform.

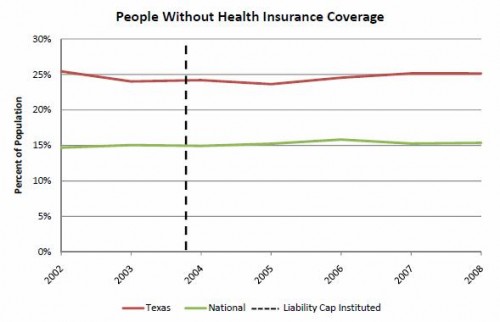

Health insurance premiums again did not see a dramatic decrease after tort reform. Do you see the increase in coverage? I ask, because I can’t. This claim is actually laughable, because Texas as a state has the highest level of uninsurance in the US. Sometimes the Washington Post baffles me. Is there any fact-checking at all?

Do you see the increase in coverage? I ask, because I can’t. This claim is actually laughable, because Texas as a state has the highest level of uninsurance in the US. Sometimes the Washington Post baffles me. Is there any fact-checking at all?